A comprehensive guide to queue management systems in banks

Queues are often customers’ first and most direct interaction with bank branches, influencing their perception and long-term loyalty. Thankfully, banks are increasingly managing queues with software today, a remarkable leap from the simplicity of early banking. This technological advancement indicates how much customer service and operational efficiency in this sector has evolved and continues to.

Perhaps it might be useful to take a short trip through history for some interesting context: In the first days of North American banking, the first U.S. bank, the Bank of North America, began operations in 1782 in a simple Philadelphia store. Early customer service in banking was rudimentary until the 1876 introduction of the telephone, which significantly enhanced customer interaction. By the 1920s, with growing consumerism and the introduction of credit lines, customer service became more structured, culminating in AT&T’s 1967 introduction of the toll-free number, which changed the face of direct consumer-company communication.

Despite advancements in digital technology and the ability to conduct financial transactions remotely, many banking halls still experience a significant influx of visitors. So, effectively managing foot traffic in these institutions remains important. Robust queue management is pivotal in ensuring operational efficiency and maintaining high customer service standards.

Common problems queue management systems solve in banks

For clarity, here are some specific problems that banks look to robust queue management systems to solve:

- Crowded bank branches and long waiting times are causing stress for both staff and customers and diminishing the overall banking experience.

- Inefficient service delivery and extended wait times are leading to a decline in customer satisfaction at bank branches.

- Struggles with managing the flow of customers and ensuring efficient use of staff time, impacting service quality.

- Challenges managing customer demand and waiting area capacity to avoid overcrowding and long waits.

- High rates of no-shows and customers arriving unprepared for their banking services cause operational inefficiencies.

- Communication gaps among staff and lack of actionable data hinder effective decision-making.

Queue management systems in banks can turn these around and achieve great customer service and operational efficiency by–

Reducing client waiting times: A robust queue management system cuts down on the time clients spend waiting by organizing and streamlining queues. Customers in banks can join virtual queues and get updates in real-time about their position, resulting in them arriving just in time and prepared for service. This reduces frustration and the feeling of long wait times, and customers can use their waiting time for other purposes.

Resource allocation in branches: Queue software helps to better manage staff according to the immediate demands. Financial institutions can understand the number of clients and their requirements and adjust their staff accordingly, resulting in quicker service and smarter use of staff time. Employees can also receive specialized training in particular service categories, allowing customers to be directed to them seamlessly, eliminating any confusion.

Gathering and analyzing client flow data: An efficient queue management system should collect data about how clients move and how long services take. Financial institutions can leverage this data to analyze peak hours, determine average waiting times, and identify trends. This information aids in making informed decisions regarding staffing and service optimization.

Supporting communication with clients: Banks can inform their clients about their queue status and other important information through digital signs, text messages, or app notifications. This makes clients feel more informed and less worried about waiting.

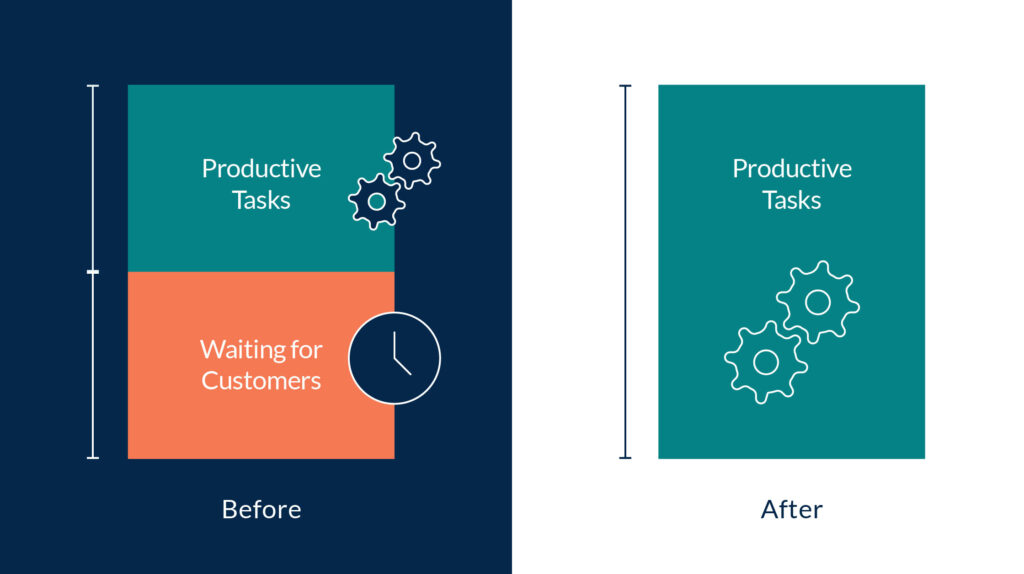

Streamlining banking processes: Robust queue management software in banks streamlines customer flow and automates routine tasks, significantly reducing idle time for staff who would otherwise wait for walk-in customers. This efficiency allows staff to focus on productive tasks and value-added services, enhancing overall operational effectiveness.

The choice of the queue management system has a direct impact on revenue and profitability

Effective queue management systems are key in influencing the bottom line of banks. Research has shown that a robust queue management system enhances customer satisfaction and reduces wait times for pre-booked and walk-in clients. Extended waiting periods inevitably result in customer dissatisfaction, dwindling loyalty, and potential loss of business.

Queue management systems should do more than just manage lineups; a modern QMS should provide in-depth service operations analytics. Advanced analytics enable banks to identify and implement small but impactful improvements across different areas of service delivery. These improvements can range from increased productivity and better risk control to accelerated growth through targeted customer interactions.

Improvement in customer experience often leads to increased profitability. McKinsey says, “A seamless customer experience can be worth at least as much as a superior product or efficient process—building customer loyalty, reducing costs, making employees happier, and boosting revenues significantly.” Especially in the current banking landscape, where customers have numerous options, and the high service standards in various sectors shape their expectations. Queue management efficiency becomes vital to a bank’s customer experience strategy.

How does a bank go about selecting and deploying a queue management system?

Let’s begin with an overview of what a queue management system represents in the current era, given the advancements in digital technology and the heightened ‘phygital’ expectations of customers frequenting banking halls. (Phygital refers to blending digital experiences with physical ones).

It goes beyond merely organizing lines; it’s about enhancing the customer experience. Customers join queues digitally through various devices, reducing the need for physical waiting and improving convenience with automated notifications to keep customers informed about their queue status and what they need to know for effective service. The system also collects customer flow and service efficiency data, which banks use to optimize staff allocation and service delivery. Other common capabilities include integrating existing CRM systems and digital signage to provide real-time queue updates.

Top features modern banks require in a QMS

Real-time monitoring: This feature is crucial for customers and bank staff. For customers, it provides live updates on their queue status, estimated wait times, and alerts when their turn approaches. This transparency helps in managing their expectations and enhances their overall experience. For staff, real-time monitoring offers insights into customer flow and service demand, enabling them to manage resources efficiently and respond proactively to any bottlenecks or surges in demand.

Multi-channel support: A queue management system must support multiple customer interaction channels in today’s interconnected world. This includes physical ticketing systems in the bank, online appointment booking, mobile app integration, and even social media channels. Multi-channel support ensures that customers can interact with the bank’s queue system in a way that is most convenient for them, whether they are tech-savvy or prefer more traditional methods. It also helps reach a broader customer base and adapt to varying customer preferences and behaviors.

However, beyond these basic features, financial institutions require adaptable queue management solutions to meet the needs of modern banking customers and solve unique operational challenges while staying ahead of the curve.

The significance of customizable and unique queue management solutions in banking institutions

- Tailored customer experience: Each bank has unique services, client demographics, and operational workflows. Customization allows the queue management system to align with these specific characteristics. This means that the system can be designed to handle different types of transactions differently, optimizing the customer journey based on the service they require, whether it’s a quick cash withdrawal or a more time-consuming mortgage consultation.

- Efficient resource allocation: Banks vary in size, location, customer base, and peak hours. A customizable system can be programmed to adapt to these factors, ensuring staff are allocated efficiently. For instance, during busy periods, the system can be easily adjusted to allocate more staff to high-demand services.

- Integration with existing systems: Banks often have established IT infrastructures and databases. Customization ensures that the new queue management system can seamlessly integrate with these existing systems, such as CRM or banking software. This integration is crucial for maintaining data continuity and providing a holistic view of customer interactions.

- Compliance and security: Financial institutions are subject to stringent regulatory requirements. Customization allows the queue management system to comply with local and international regulations, including data protection laws, ensuring that customer data is handled securely and complies with legal standards.

- Scalability and future-proofing: Banks are continually evolving, and so are their service offerings. A customizable system can scale and adapt to future needs, whether expanding to new branches, incorporating new technologies, or adapting to changes in banking regulations.

Key considerations for banks deploying or replacing a queue management system

Implementing a queue management system in a bank involves several key considerations, each with its own set of challenges and requirements. Here’s an overview of these considerations, drawing on multiple sources:

Cost considerations:

- Hardware and software expenses: These include the initial purchase or lease costs of IT equipment, software solutions, licensing, and subscriptions. The costs vary based on the number of users and whether the system is a one-time purchase or a cloud-based system with annual fees.

- Operational impact: The cost-effectiveness of solutions that enhance efficiency, enable integration, and improve decision-making should be evaluated. These solutions can reduce manual tasks and focus staff on more revenue-generating activities.

- Training and education: Training costs can vary significantly based on the new system’s complexity. More complex systems or significant upgrades might require extensive training, which can be costly.

- Support and maintenance: These often-underestimated costs include security upgrades, software updates, hardware repair, and general support. They are essential to the ongoing use of technology.

Scalability:

Scalable queue management systems should integrate with existing banking systems and infrastructure, including core banking software, customer databases, and other relevant systems such as digital signage.

The challenge in integration often lies in the complexity and the need for technical expertise. Integrating banks’ direct connectivity solutions can be complex and time-consuming, even for skilled teams. This complexity can overwhelm teams without prior experience in cash management and bank integrations. High upfront investment is often required for bank integrations, with a steep learning curve and a development period that can span 3-6 months. Due to reliance on niche connectivity protocols and file formats, these integrations typically result in sunk costs.

The system should also support omni-service channels, offering multiple options like self-service kiosks and virtual queues or meetings accessible through mobile apps or online platforms. This flexibility is key for catering to different customer preferences and expanding services.

Step-by-step guide on implementing a system in a banking environment.

Needs Assessment:

- Evaluate the specific needs and challenges of the bank.

- Identify the types of services offered and customer flow patterns.

Technology Selection:

- Choose a system that aligns with the bank’s operational requirements and customer expectations.

- Consider scalability and flexibility.

Customization and configuration:

- Customize the system to fit the bank’s specific workflows, services, and customer handling processes.

- Set up parameters like service types, employee roles, and queue logic.

Integration with existing systems:

- Setup integration with CRM, banking software, and other IT infrastructure.

- Ensure data synchronization and compliance with security standards.

Staff training:

- Train employees on how to use the new system effectively.

- Emphasize the benefits and changes in workflow processes.

Pilot testing:

- Implement the system in a controlled environment or selected branches.

- Monitor performance and gather feedback from both staff and customers.

Customer communication:

- Inform customers about the new system and how it will improve their service experience.

- Provide guides or tutorials for any customer-facing interfaces.

Data analysis and adjustment:

- Analyze data collected during the pilot for insights into customer behavior and system performance.

- Make necessary adjustments based on feedback and data analysis.

Full-scale implementation:

- Roll out the system across all branches.

- Ensure consistency and standardization in all locations.

Ongoing support and maintenance:

- Ensure continuous technical support for system-related issues.

- Regularly review the system for improvements and compliance with new regulations.

Continuous evaluation and enhancement:

- Regularly assess the system’s performance and impact on customer satisfaction.

- Make iterative improvements based on evolving customer needs and technological advancements.

Successful consumer banking operations hinge on customer satisfaction and service efficiency. Queue management, though seemingly straightforward, is a vital aspect of the service experience for customers and staff. Therefore, adopting a robust, technologically advanced queue management system is essential for banks aiming to thrive and meet contemporary customer demands.

WaitWell is a leading choice for modern banks looking to deploy a technologically advanced queue management system. Our system revolutionizes bank queue management by reducing wait times and stress through a robust and fully customizable digital system for appointments and walk-ins, coupled with workflow capabilities, real-time analytics, and personalized customer service features.